Working Together to Maximize Your Credit

Credit plays a crucial role in your financial life. Small issues can prevent you from financing your home or car, qualifying for loans or new credit, or even getting a new job.

If you’ve been turned down for financing or only offered ridiculous interest rates, Credit Repair may be a great fit for you! We leverage consumer protection laws and strong dispute tactics to help you get the credit you deserve. Keep reading below to find out more, or…

Our Services

Look What We Can Do for You and Your Credit

Credit Strategy

Find out how to increase your credit scores in as little as 45 days with our 12 Point Credit Accelerator System. The session is only 15 minutes or less and it’s FREE. Click the button below to schedule a Session.

Credit Repair

You’re unique, and your situation needs personal attention. We not only dispute negative items, we help you build credit, and fight erroneous account reporting with the help of Consumer Attorneys.

Business Credit

Build credit with your EIN instead of your SSN! We can help you build a strong business credit profile. A perfect alternative to loans when you need capital to start, fund, or grow your business.

Our 12 Point Credit Accelerator System

We’ve got this down to a science! Take a look at the proven process we’ve refined over the years:

-

PHASE III (DAYS 15+)

DISPUTE FACTUAL DISCREPANCIES

We create custom factual disputes to challenge errors on your credit report to remove derogatory items holding back your scores.

-

PHASE III (DAYS 15+)

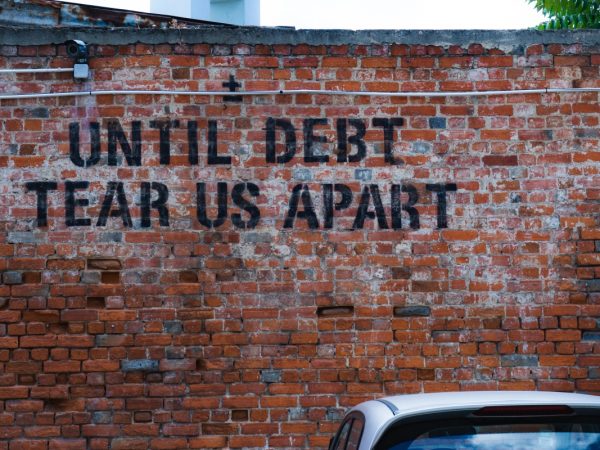

DEBT REDUCTION STRATEGY

Utilization is 30% of your credit scores in most scoring models. If needed, reducing your debt will help increase your scores.

-

PHASE II (DAYS 5-15)

ACCOUNT VERIFICATION

We request the credit bureaus to verify all accounts and the information reporting about the accounts using the FCRA Section 609(a)(1)(A).

-

PHASE II (DAYS 5-15)

VALIDATE COLLECTIONS

We request validation for any debt trying to be collected by Collections Agencies that are reporting on your credit. (FDCPA 1692g)

-

PHASE II (DAYS 5-15)

REQUEST ACCOUNT DETAILS

We request details on accounts from the original creditors using the FCRA Section 623.

-

PHASE II (DAYS 5-15)

AUDIT COLLECTIONS LETTERS

Collection companies often send letters that do not comply with the Fair Debt Collection Practices Act. Our associate attorney audits for violations.

-

PHASE 1 (DAYS 1-5)

ACTION PLAN

We give you an Action Plan that outlines our plan of action and what you need to do to increase your credit scores and improve your overall credit file.

-

PHASE I (DAYS 1-5)

CREDIT STRATEGY SESSION

Find out how to increase your credit scores in as little as 45 days with our 12 Point Credit Accelerator System. The session is only 15 minutes or less and it’s FREE.

-

PHASE I (DAYS 1-5)

CREDIT ANALYSIS

After your credit strategy session we provide you with a Full comprehensive review of all your credit reports.

-

PHASE III (DAYS 15+)

CREDIT BUILDING

If you do not have positive accounts reporting your scores will not rise. We help you build credit the right way with the right accounts that will help increase your scores.

-

PHASE IV (DAYS 60+)

ATTORNEY INTERVENTION

If required, we will have our trusted consumer attorneys engage with the creditors, credit bureaus and collections agencies in violation to file suits.

-

PHASE IV (DAYS 60+)

SUE OR SETTLE

If at first you don’t succeed – escalate the case! And that is just what we do to ensure your credit is the best it can be.

Ready to Start Repairing Your Credit? We’re Here to Help!

Do you have questions or concerns? We have answers! When you call us, you’ll receive a totally free, no-pressure Credit Consultation with friendly, trained credit pros who treat you like a person! Call now, or if you’re feeling phone shy, just click below!